EARLIER this year authorities in Switzerland pronounced they had begun rapist investigations into dual former officials during 1MDB—a Malaysian state investment organisation from that they trust some $4 billion might have been wasted by a array of deals struck between 2009 and 2013. On Apr 12th a Swiss pronounced a range of their enquiries was widening, and that they have now also non-stop files on dual former open officials from a United Arab Emirates.

This latest escalation relates to a understanding struck in 2012, in that IPIC, an Abu Dhabi state fund, concluded to pledge holds lifted by 1MDB to squeeze dual energy firms. 1MDB paid billions of dollars in material (and other monies associated to a guarantee) to a association purebred in a British Virgin Islands, that gimlet a identical name to one of IPIC’s subsidiaries. But on Apr 11th IPIC released a matter to a London Stock Exchange confirming rumours that it did not possess a firm.

Switzerland

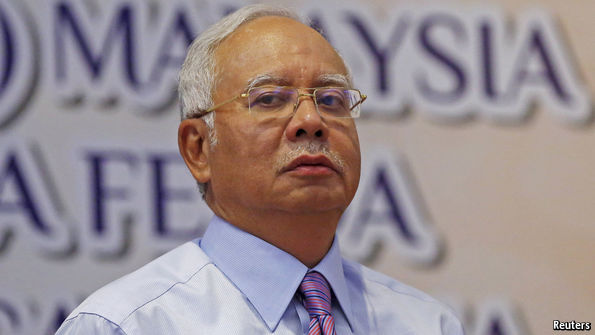

The Swiss investigators contend they have reason to think that instead of going to IPIC a sums benefited a dual Emirati open officials it is investigating, as good as “a association associated to a suit design industry”. In early Apr a Wall Street Journal reported that investigators in dual countries trust some-more than $150m imagining from 1MDB found a approach to Red Granite Pictures, a film-production association co-founded by a stepson of Malaysia’s primary minister, Najib Razak. This organisation subsequently financed “The Wolf of Wall Street”, a Hollywood film about a epicurean crook, starring Leonardo DiCaprio.

Red Granite denies any indiscretion and says it is co-operating with enquiries. 1MDB says it finds IPIC’s explain not to have benefited from a payments “surprising”, and says it has not given income to Red Granite. Swiss authorities note that a dual Emiratis underneath investigation, like all defendants, are “presumed innocent”.

The Swiss attorney-general’s matter comes days after a recover of a long-awaited news into 1MDB’s affairs, constructed by MPs on Malaysia’s public-accounts committee. That enquiry was temporarily dangling final summer when Mr Najib promoted several of a committee’s members to a cabinet. The news identifies irregularities in several vast transactions, yet it stops brief of alleging undisguised fraud. Tony Pua, an antithesis lawmaker and one of a report’s authors, regrets that 1MDB was incompetent to yield a cupboard with all a support it requested.

The news lambasts a organisation for borrowing billions, most of it underneath a Malaysian supervision guarantee, though securing adequate income upsurge to use a debt (which in Jan stood during around $12 billion though that will substantially shortly tumble as 1MDB sells off large land and energy holdings). Its authors criticize 1MDB’s house for unwell to scrupulously scrutinize a executives, and suggest that military examine a firm’s former boss, Sharol Halmi, who now works in a primary minister’s office. But they have zero to contend about a $1 billion or so that is pronounced to have entered accounts belonging to Mr Najib, some of that critics lay was siphoned out of a firm. (Mr Najib says that he has never taken open income for personal gain; Malaysia’s attorney-general says a primary apportion perceived a authorised personal concession from a Saudi royal, and that most of a income was returned.)

1MDB’s house immediately offering to step down—perhaps gratified to extricate themselves from what has turn one of a biggest controversies in Malaysian domestic story (it is not transparent if their resignations have been accepted). Mr Najib’s stay says a news is serve explanation that a primary apportion has finished zero wrong. But a committee’s hearings have drawn larger courtesy to a territory in a 1MDB’s articles that appears to contend that a organisation might make no vital investment though a primary minister’s approval. Mr Pua has created that Mr Najib’s signatures are “littered all over 1MDB”.

The swell of unfamiliar investigations—under approach not only in Switzerland though also in America, Singapore, Hong Kong and a UAE—will be closely watched by banks that helped 1MDB lift money, rubbed a firm’s income or took Mr Najib’s deposits. Their ranks embody Goldman Sachs, BSI, a Swiss private bank, and AmBank, that is part-owned by Australia’s ANZ. As for Mr Najib, whose celebration has led Malaysia’s statute coalitions for 6 decades, his position looks protected for a moment. The public-accounts committee’s news outlines a finish of a handful of central enquiries into 1MDB’s exchange that Malaysia launched final year. The content of an progressing report, constructed by a auditor-general, has been announced an central secret.