Image may be NSFW.

Clik here to view.

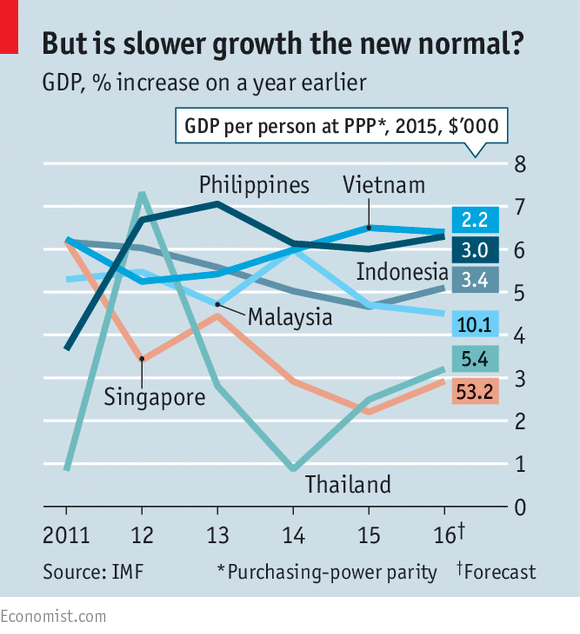

WHEN we cruise a backdrop of diseased tellurian demand, a unsuitable Chinese economy and doubt over American financial policy, afterwards a predictions for South-East Asian economies seem utterly upbeat. Of a 10 countries in a region, usually little Brunei is tighten to recession. Indeed a Asian Development Bank (ADB) forecasts that expansion in informal GDP will stand from 4.4% final year to 4.5% this year and 4.8% in 2017. But reason that backdrop in mind: such forecasts might infer too optimistic, generally if tellurian financial markets get another hitch of jitters like those progressing this year, and unfamiliar collateral is pulled out in a hurry.

The region’s healthiest economies are those of Vietnam and a Philippines: both have immature populations and rest reduction than many in South-East Asia on possibly China or exports of commodities, whose prices are now depressed. Growth in Vietnam was 6.7% final year, driven by competitively labelled exports. It was usually a tad reduction in a Philippines, interjection to clever services, quite call centres. Fresh investment in infrastructure in both countries is also pushing growth. But a going will not be so easy in a future. Vietnamese production would be harm by weaker tellurian trade; duration a supervision has many galumphing state-owned enterprises to combat with. And Philippine call centres face foe from automation software.

A suitable boy?

A slack in China, with a reduced direct for commodities, is attack Indonesia and Malaysia quite hard. Commodities (including coal, palm oil and nickel ore) comment for three-fifths of Indonesian exports. But taxation collection is too diseased for a supervision to do many to alleviate any negligence of growth. Hoping to coax serve investment, a supervision pronounced this week that it would cut corporate taxation from 25% to 20%. But it will substantially be years before this stimulates adequate investment to interpret into some-more taxation receipts. President Joko Widodo entered bureau in 2014 earnest to lapse a nation to 7% growth; currently that looks somewhere between illusory and impossible, notwithstanding desirous skeleton to ramp adult spending on much-needed infrastructure.

Malaysia, Asia’s biggest oil exporter, suffers not only from low commodity prices though from a primary minister’s increasingly surreal reason on power, a multiple that has put downward vigour on a currency, a ringgit. Najib Razak has spent months giving unsuitable answers to questions about how hundreds of millions of dollars upheld by his personal bank accounts. He has burst down on domestic opponents and intent in secular politics—while a cost of oil, that creates adult a fifth of Malaysian exports, has depressed by over 60% from a rise dual years ago. Strong exports of wiring give Malaysia a pillow that other oil producers lack. Yet that zone is some-more unprotected than many to tellurian demand. Malaysia’s annual GDP expansion is foresee to normal subsequent 5% to a finish of 2018. But that assumes questions over Mr Najib do not dull supervision or brief onto a streets.

Poor governance also afflicts Thailand. Last year it grew during a indolent 2.8%, following gloomy expansion of underneath 1% in 2014, after General Prayuth Chan-ocha led a manoeuvre and afterwards commissioned himself as primary minister. Domestic direct has given recovered, and tourists are entrance behind to a beaches. But doubt about a country’s domestic instruction is certainly a dampener on unfamiliar and domestic investment. Should infrastructure projects, some corroborated by China, ensue as planned, and domestic ease prevail, afterwards expansion might collect up. Yet Mr Prayuth’s group has nonetheless to attest a aptitude for mercantile management.

Beyond these economies’ evident prospects, however, longer-term issues are some-more important, as a ADB’s latest opinion highlights. Among a many critical are timorous workforces and disappearing birth rates, generally for Thailand and abounding Singapore. Another is reduce capability expansion in a future. Easy gains were done when tens of millions of bad South-East Asians changed from a panorama to work in new factories or burgeoning use sectors. But a subsequent jump will be many harder, and will count on some-more immature people removing a college education, some-more stretchable work markets, consistent upgrading of technologies and smarter, some-more manageable governments.

It is all a high order. In fact, a ADB concludes that South-East Asia, along with many of a rest of Asia, has seen a intensity expansion dwindle by over dual commission points given 2006-10: a sizzling rates of a decade ago will not lapse but that subsequent leap.